Opportunities Abound: A Deep Dive into the Rise of AEC Startups

Opportunities Abound: A Deep Dive into the Rise of AEC Startups

The past two decades have witnessed a period of unprecedented growth in global startup ecosystems, fueled by the emergence of tech hubs, globalization, and technological advancements. The AEC industry is no exception, experiencing a surge in innovative startups. Fueled by technological advancements and a growing awareness of the need for innovation, AEC startups are emerging at a rapid pace, revolutionizing the way we design, build, and manage our built environment.

From the trenches of the AEC startup world, we at e-verse understand the frustration of finding comprehensive information about this exciting ecosystem. That’s why we’ve poured our passion into creating AEC Works, a global directory of AEC startups. If you’re an AEC startup missing from the list, we’d love to hear from you! Just fill out our quick form. This is just the beginning of our journey to map and understand the incredible AEC landscape.

Additionally, driven by the same goal of creating a comprehensive understanding of the AEC startup ecosystem, we conducted in-depth research that we’ve detailed below.

Small Businesses, Big Impact: Unveiling the Power of Startups

Let’s explore some current trends in startup success, both overall and within our industry.

The most valuable startup in the world is worth 225 billion

The answer is revealed at the conclusion - were you right in your suspicion?

50 million startups are created globally each year.

Source: Microsoft

32% of all startups are in the software or data industry, representing the biggest vertical for startups (followed by Health, 13%, and Social & Leisure, 10%).

Source: Fit Small Businesses

Startups create approximately 2.29 million new jobs each year.

Source: Fit Small Businesses

5.5 new businesses were created solely in the US in 2023.

Source: Commerce Institute

ConTech Startups: The Next Big Boom?

The ConTech startup ecosystem shows strong potential for exceptional growth compared to other industries. While the construction sector, valued at over a trillion dollars, has a reputation for inefficiency and lagging behind in digital adoption, there are clear signs of a shift.

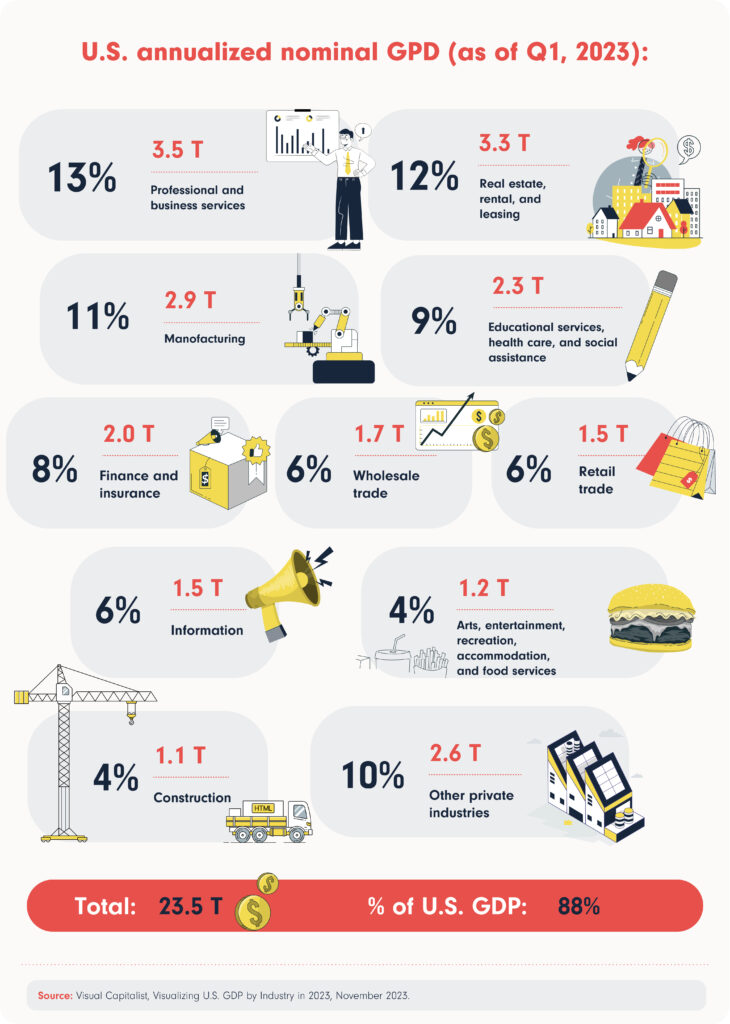

U.S. Annualized nominal GPD (as of Q1, 2023).

Numerous startups are securing significant funding to address these challenges and modernize the industry, indicating a growing embrace of digitization.

VC funding in U.S. construction tech startups reported $1.3 billion in the first half of 2022, representing a 44% increase on the previous six months.

At least 17 ConTech startups have attained unicorn valuations of +$1 billion.

ConTech funding grew 280% from its pre-2021 quarterly peak to its post-2021 quarterly peak.

The ConTech sector has now surpassed $30 billion in total venture capital funding raised (even excluding former unicorn Katerra).

Sources: Techcrunch, Foundamental (Oct.2023)

Let’s state as well, that as we see that VC investment has fallen after the 2021 pike, ConTech is a vertical growing disproportionally. According to Fundamental:

- Investment in ConTech has tripled since 2021. Construction Technology’s share of total venture funding has jumped 3-fold from pre-2021 levels to post-2021.

- ConTech companies are also getting bigger funding rounds. With a 28% increase year-over-year compared to a slight decrease for all venture capital funding, which is down 2% over the same period.

The downsides

But not everything is so magical. There are some downsides for the AEC startup scene to be cautious. For starters, we know how the pandemic brought an outburst for tech starters. According to Fit Small Business, Tech startups grew 2.3x more than non-tech startups during the pandemic, trying to cover the gap of virtuality in the new normal. However, this funding boom can’t last forever. Since the 2021 peak in global startup investment, available capital has tightened. Rising interest rates and a slowdown in money printing have contributed to this shift.

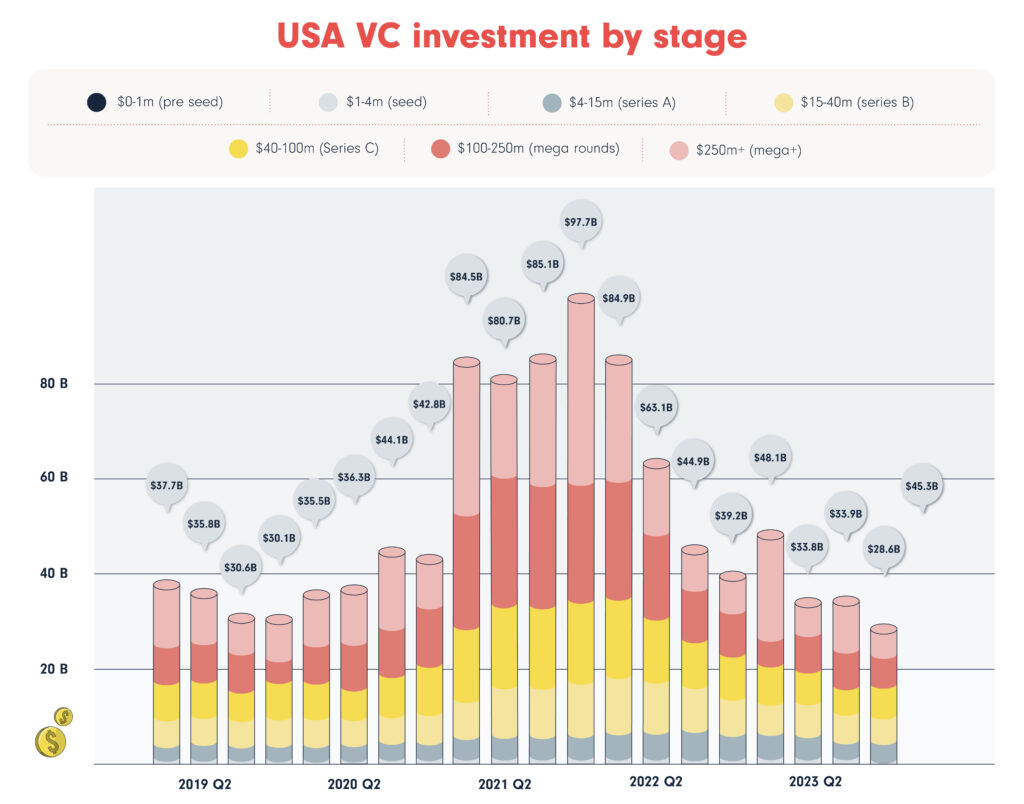

The chart below shows the 2021 peak in VC investment, followed by a return to pre-pandemic investment levels.

At the same time, the Contech startup ecosystem has its own risks. According to Construction Connect, the Construction industry has the second-highest failure rate as of 2022. Data from the Bureau of Labor Statistics reveals a stark reality: only 17.2% of construction firms launched in 2001 survived for a decade. With an 82.8% failure rate within ten years, and a 44% rate within three years, starting a construction company is no easy feat. These numbers position construction as the vertical with the lowest chance of survival, after manufacturing, services, retailing, finance, communications, and many more, according to Small Business Trends.

AI-nnovation Explosion: How Startups Can Ride the Coming AI Wave

The global startup ecosystem itself is continuously expanding. Factors like increased internet access, mobile technology penetration, and a growing culture of entrepreneurship contribute to this rise. Each period has seen particularly significant surges in startup creation:

- The Dot-com boom of the late 1990s witnessed a massive influx of internet-based startups.

- More recently, the rise of mobile technology and app development has fueled another significant wave of startup activity.

- Now it’s AI time. Let’s double down on this.

We all know it’s huge and an impressive hype. what we still need to know is a) if the promises made will actually be completed, and b) up to what extent will ai take over human’s job and what will still be in the rein of creative real person capabilities.

Let’s read through the numbers:

While startup funding is generally decreasing (as we mentioned, we hit an all-time pique in 2021), generative artificial intelligence (AI) companies like ChatGPT and Anthropic are in their heyday and enjoying more demand than ever. According to PitchBook data. funding for generative AI startups reached nearly $1.7 billion in the first quarter of 2023, a 52% increase from just $820 million in Q1 of 2022. Meanwhile, investors are also seeing up to 80% more pitches from AI startups.

Funding for generative AI startups increased by 52% in Q1 2023, in comparison to Q1, 2022.

Funding for generative AI startups reached $1.7 billion in Q1, 2023 (from $820 million in Q1 of 2022)

Investors are seeing up to 80% more pitches from AI startups.

Regardless of the significance AI has taken over the tech world, let’s not forget some other AEC ecosystem’s big trends that can increase performance from innovative technologies. These are Building Information Modeling (BIM), Augmented reality (AR), and Virtual Reality (VR), some of the technologies that allow these young companies to streamline workflows, enhance project efficiency, and promote sustainability. As the AEC sector continues to embrace digitalization, we can expect even more groundbreaking solutions to emerge, further shaping the future of our built environment.

Delving Deep: A Look at Today’s AEC Startup Landscape

Having explored the broader startup ecosystem and the exciting prospects for AEC in particular, let’s dive into the current state of AEC startups. This analysis unveils the vibrant landscape of these innovators. By examining their geographic spread, sub-sector focus, and team size, we gain crucial insights into the industry’s ongoing transformation. As these disruptors push boundaries and revolutionize traditional approaches, we can expect a future AEC characterized by enhanced efficiency, sustainability, and a seamlessly connected built environment.

Geographic and Market Insights

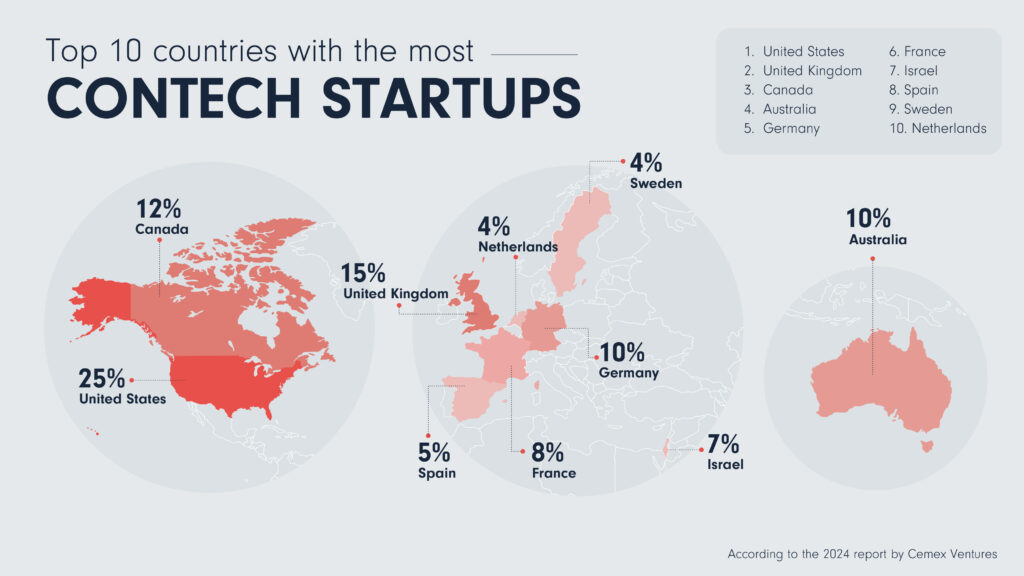

According to the 2024 report by Cemex Ventures, the distribution of ConTech startups is predominantly concentrated in a few key countries. The top ten countries with the most ConTech startups are:

- United States: 25%

- United Kingdom: 15%

- Canada: 12%

- Australia: 10%

- Germany: 10%

- France: 8%

- Israel: 7%

- Spain: 5%

- Sweden: 4%

- Netherlands: 4

We can see a clear dominance of English-speaking countries in establishing AEC startups, regardless of their physical location. The United States, United Kingdom, Canada, and Australia lead the pack in terms of startup prevalence. These countries also boast a high concentration of both AEC startups and venture capital investments in the ConTech space.

Following these leaders, a significant number of startups emerged from Europe, including Germany, Israel, France, Spain, Sweden and the Netherlands. (Cemex Ventures) (Cemex Ventures) (MarketScreener) (Startup World).

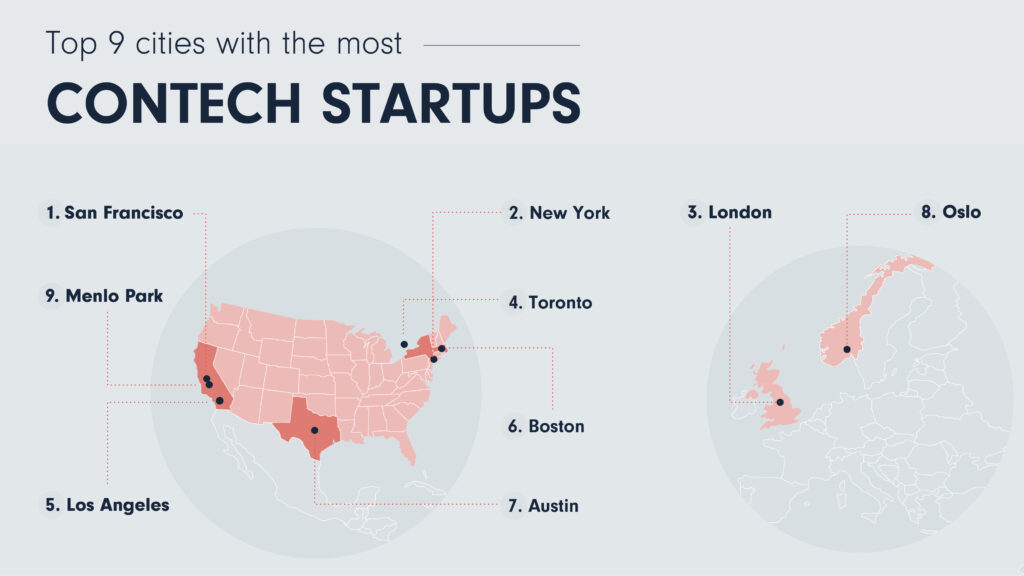

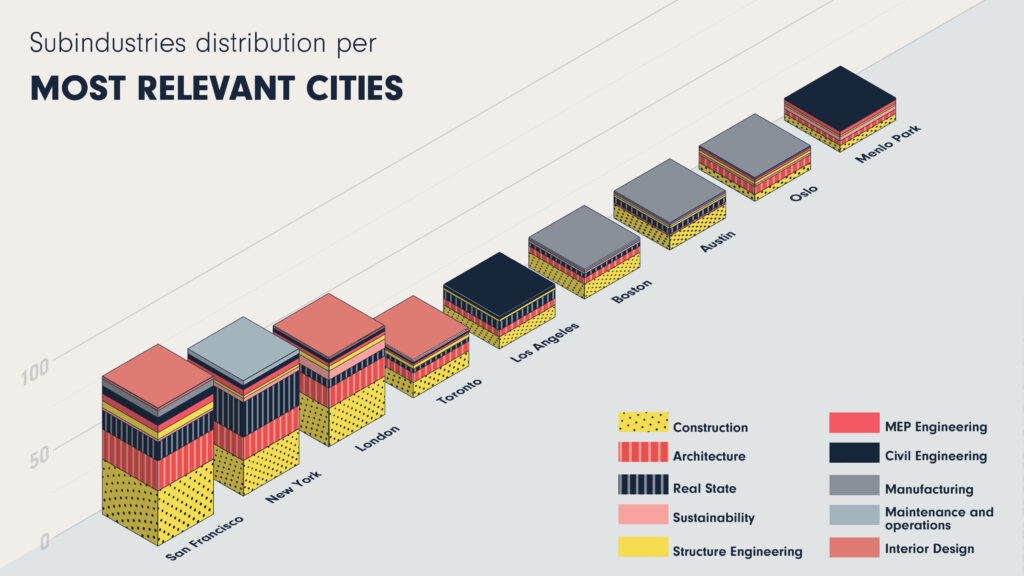

City-wise, major hubs like San Francisco, New York, London, Toronto, Los Angeles, Boston, Austin, Oslo, and Menlo Park dominate, with Oslo notably standing out among the non-English predominant cities.

Industry Sub-Verticals

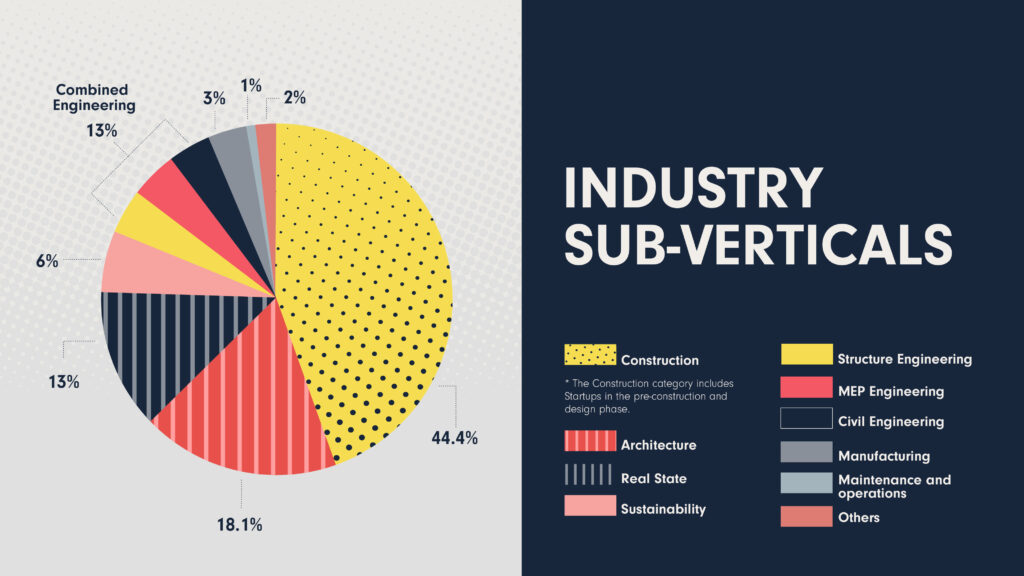

Our analysis of AEC startups across various sub-verticals reveals diverse areas of focus, which do not necessarily align with the traditional order of architecture, engineering, and construction. Here’s the global distribution within the AEC sector:

- Construction: 44%

- Architecture: 18%

- Combined Engineering: 13% (Structural 4.3%, MEP 4.2%, Civil 4.2%)

- Real Estate: 13%

- Sustainability: 6%

- Manufacturing: 3%

- Maintenance and Operations: 1% **Add a note to this chart: The “Construction” category included startups in the pre-construction and design phase.

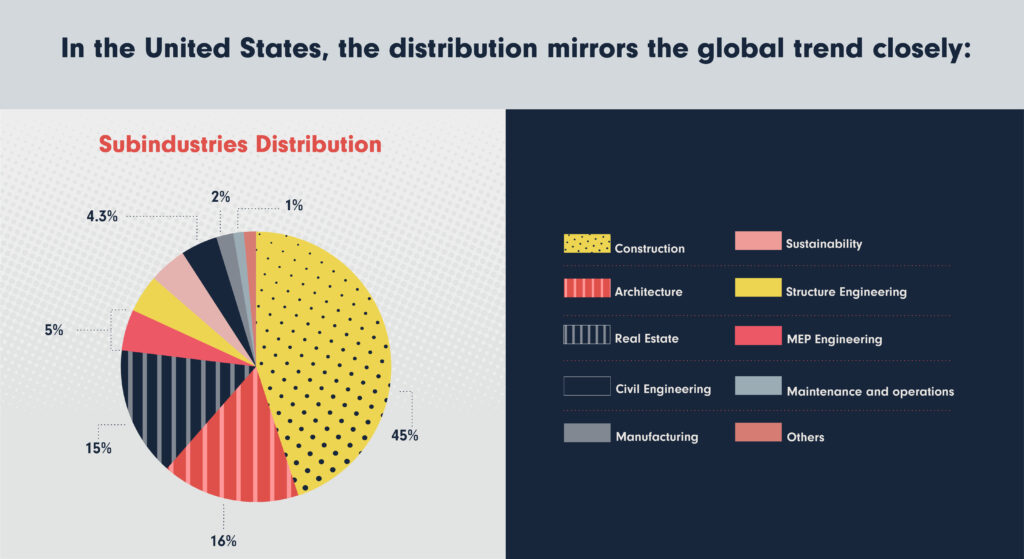

In the United States, the distribution mirrors the global trend closely:

- Construction: 45%

- Architecture: 16%

- Real Estate: 15%

- MEP Engineering: 5%

- Civil Engineering 4.3%

- Manufacturing 2%

- Maintenance and Operations 1%

However, other markets show distinctive focuses based on their unique expertise and market needs. For instance:

- The United Kingdom has over 10% of startups focusing on sustainability.

- In Canada, construction claims nearly 60% of the sector.

- France emphasizes architecture, which represents 26% of its AEC startups.

- Norway has significant contributions from various engineering sub-verticals. While construction represents only 33%, engineering overall is very relevant, representing 28%.

These insights also extend to city-specific trends, where certain cities attract startups focused on particular sub-verticals. For example, while San Francisco leads overall, New York excels in real estate and maintenance operations (doubling San Francisco’s numbers). Meanwhile, sustainability-focused startups cluster in Miami and Seattle, alongside Menlo Park.

Despite a tendency towards centralization in countries like the UK and Canada, the US exhibits impressive decentralization, with over 30 cities featuring prominently across different sub-verticals. On the opposite side, we see countries like the United Kingdom which is extremely London-based, accounting for over 85% of startups. Canada has a big relevance for Toronto and Vancouver, and in a few cases only, Montreal.

Employee Metrics

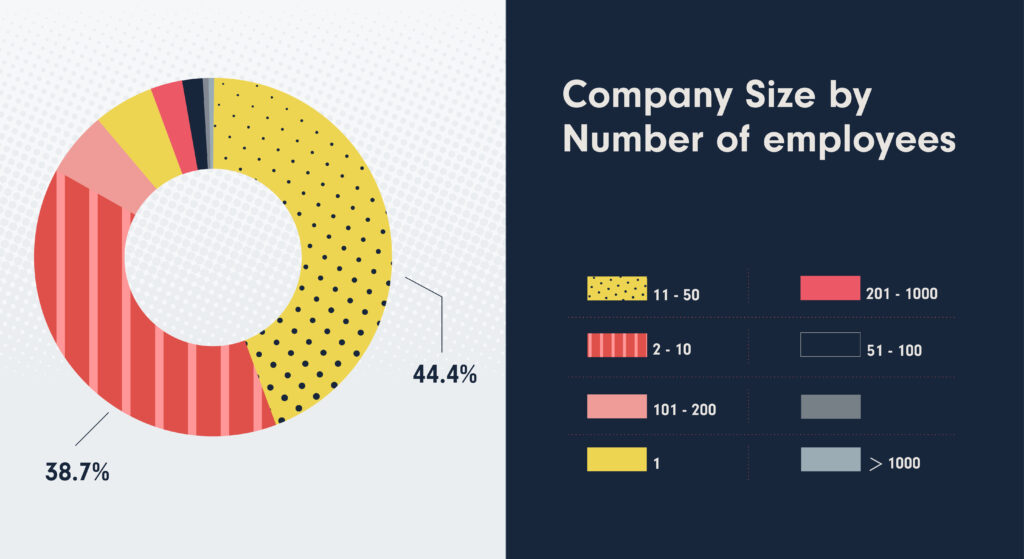

Commonly, startups, particularly tech-focused ones, operate with smaller teams. Our data indicates that 39% of AEC startups employ between 2 and 10 individuals, while 44% have teams of 11 to 50 members. Meaning that the vast majority (over 83%) has less than 50 employees. This trend remains consistent across different countries, with no surprises.

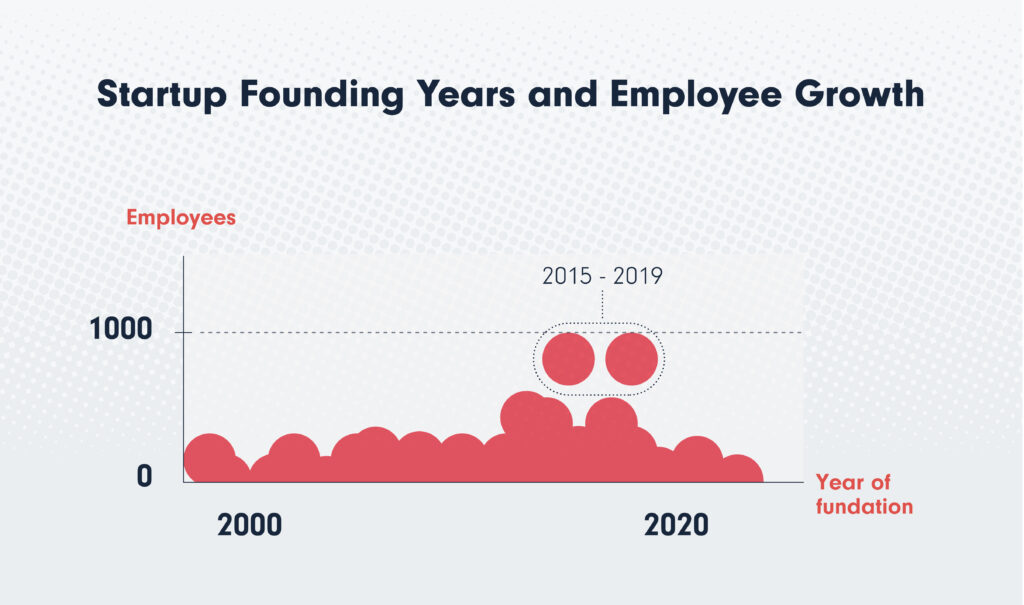

An intriguing observation emerges when correlating startup founding years with employee growth. Specifically, startups founded between 2015 and 2019 exhibited remarkable growth in employee numbers, a trend not observed in other periods, including pre-2015 and post-pandemic years up to 2023. This anomaly raises questions about the factors influencing such growth, whether they be a specific investment climate, market conditions, or other variables. We invite readers to share their hypotheses and insights on this phenomenon in the comments section below.

Conclusions: a bright future for the AEC

Looking ahead, the future of AEC appears bright. As these startups continue to innovate and disrupt traditional approaches, we can expect a future characterized by enhanced efficiency, sustainability, and a seamlessly connected built environment. The groundwork for a more efficient and innovative AEC industry is being laid right now, and the potential for positive change is significant.

- English-speaking countries dominate: The US leads the pack, followed by the UK, Canada, and Australia, with major hubs like San Francisco, New York, London, and Toronto attracting a significant portion of startups.

- Diverse sub-vertical focus: Construction claims the largest share, followed by architecture, real estate, and various engineering disciplines. Interestingly, specific markets exhibit unique specializations, with the UK prioritizing sustainability and France emphasizing architecture.

- Team sizes lean towards smaller teams: Startups, particularly tech-focused ones, typically operate with teams ranging from 2 to 50 individuals, but a recent growth trend is worth exploring.

- Intriguing employee growth trend: Startups founded between 2015 and 2019 display a remarkable surge in employee numbers, suggesting a potential correlation with specific investment climates or market conditions.

In a nutshell: A global surge in AEC startups is transforming the industry. The future of AEC is bright, with innovation poised to drive efficiency and sustainability.

The answer is revealed at the conclusion – Were you right in your suspicion? The most valuable startup in the world, worth 225 billion is ByteDance, the tech startup behind TikTok.